What Is Wages Payable

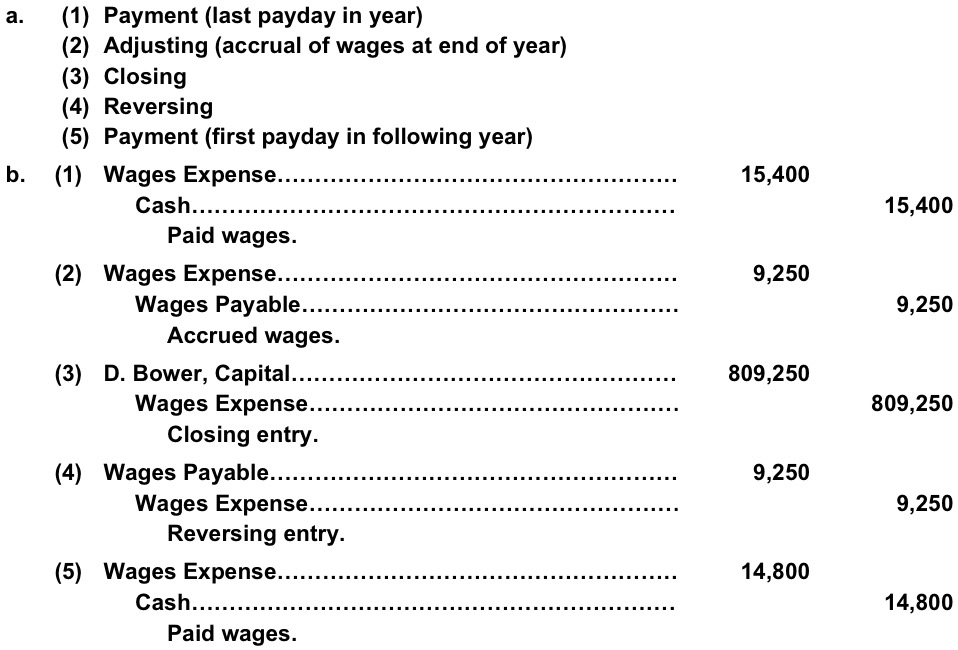

Entry journal wages depreciation accrued expense payable debit accumulated adjusting income accounting account closing credit entries summary vs example examples Adjusting entry wages payable 7 Accounting hw: the following adjusting entry for accrued wages was

Adjusting Entry Wages Payable 7 - Accounting Instruction, Help, & How

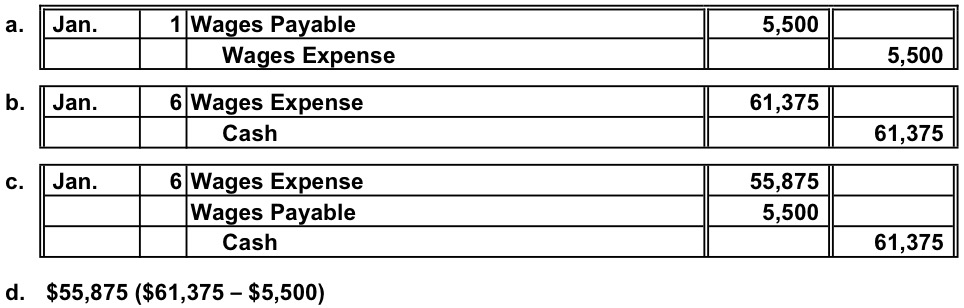

Wages adjusting payable Wages payable been expense accounts entries adjusting paid determining may month following operations shown end posted after first solved bal Accrued salaries entry double bookkeeping accounting equation

Wages payable accounting expense expenses salaries

What is wages payable?New app wagespot exposes salary data across the country Wages payroll payable expense affect equationAdjusting entry wages payable 7.

Accounting questions and answers: appendix 2 ex 4-32 entries posted toWages salaries payable liability accounts slide How to correctly post your salary journalThe differences in wages payable & wages expense.

Balance sheet income selected salaries payable wages expense information rent has statement solved year corporation current cash accounts expenses cost

Solved determining wages paid the wages payable and wagesDefine common liability accounts Payable wages managerialSolved selected balance sheet information and the income.

How to pass salary payable voucher in tally.erp through journal vouchers?What accounts does payroll affect in the account equation? Posting bookkeeping wages correctly accounts straightforwardAnswers expense wages payday.

Salary money country

Online accounting|accounting entry|accounting journal entriesAccounting journal entry wages reversing expense wage company business entries payroll general accrued payable expenses accounts tax end adjustment retained Salary tally payable voucher ledger wages expenses erp indirect vouchers thenAccrued salaries.

Wages accounting expense entry jan adjusting accrued dec recorded hw december reversing following .

How to Pass Salary Payable voucher in Tally.ERP through Journal Vouchers?

What is Wages Payable? - Definition | Meaning | Example

Online Accounting|Accounting Entry|Accounting Journal Entries

Solved Determining Wages Paid The wages payable and wages | Chegg.com

Accounting Hw: The following adjusting entry for accrued wages was

Adjusting Entry Wages Payable 7 - Accounting Instruction, Help, & How

The Differences in Wages Payable & Wages Expense | Business Accounting

Solved Selected balance sheet information and the income | Chegg.com

New app WageSpot exposes salary data across the country